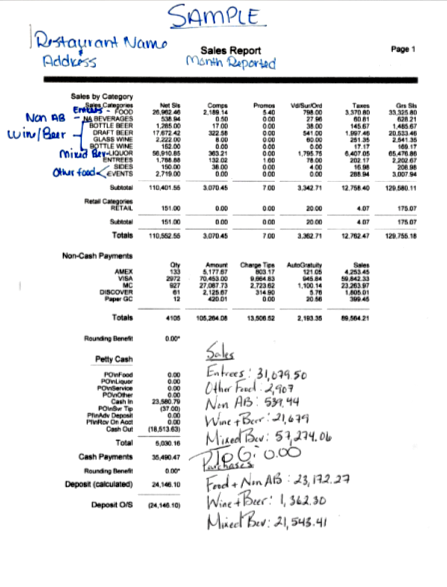

Recordkeeping when you are dealing with a deadly serious entity like VA ABC Authority should not be taken lightly. ABC Consulting works with clients, on a daily basis, that become filled with dread as they haven’t been able to keep up with record keeping or training their employees. ABC Consulting is a team of subject-knowledge experts who are true professionals, well versed in the ins and outs of VA ABC Authorities. We offer a complete line of education and consulting services and with years of experience in the business and as the CEO of ABC Consulting, I continue to gain skills, experiences and connections that help me to understand and explain how vitally important record keeping is. This article will give you the highlights. Keep your Point of Sale (POS), cash register, sales ledgers – broken down into daily, weekly, and monthly reports. Every sales ticket (to include cash sales and buffet tickets), must be kept and attached to your daily report. Each report should indicate the following:

Sales

- Entrees (items with sides, buffet, or substantial meals such as spaghetti)

- Other Food (appetizers, side items, desserts)

- Non-Alcoholic Beverages (soda, tea, coffee etc.)

- Wine & Beer (this is the only category that can be combined)

- Mixed Beverages (this include liquor, shots, mixed drinks, and mixers)

- To Go (these items cannot count towards your minimum sale requirement or ratio.)

- Miscellaneous (hookah, tobacco, calendars, shirts, etc)

Purchases

- Food and Non-Alcoholic Beverages

- Wine & Beer

- Mixed Beverages

Miscellaneous

Sales total must be less sales tax and not include Discounts/Comps. For example:

- $10.00 Burger

- + $1.00 Sales Tax

- = $11.00

- – $5.00 Employee Discount

- (Therefore, your Reported Sales Amount is $5.00)

Mixed Beverage Minimum Requirements

- Entrees is $2,000

- Total Food is $4,000

Wine and Beer

- Entrees is $1,000

- Total Food is $2,000

All totals reported must match what is reported to the VA Dept. of Taxation. Keep sales records for 2 years. How can we help? : 800.785.0161

*Disclaimer: The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. Information on this website may not constitute the most up-to-date legal or other information. This website contains links to other third-party websites. Such links are only for the convenience of the reader, user, or browser; ABC Consulting VA, LLC does not recommend or endorse the contents of the third-party sites. Readers of this website should contact their attorney to obtain advice with respect to any particular legal matter. No reader, user, or browser of this site should act or refrain from acting on the basis of information on this site without first seeking legal advice from counsel in the relevant jurisdiction. Only your individual attorney can provide assurances that the information contained herein – and your interpretation of it – is applicable or appropriate to your particular situation. The views expressed at, or through, this site are those of the individual authors’ writing in their individual capacities only. All liability with respect to actions taken or not taken, based on the contents of this site, are hereby expressly disclaimed. The content on this posting is provided “as is;” no representations are made that the content is error-free. In no capacity do we represent the Virginia Alcoholic Beverage Control Authority, IRS, SCC or any other government agency.