Part of ABC Consulting’s consulting services includes business coaching about what you MUST do, WHEN to do what, what you CANNOT do and etc. etc. This blog is about Recordkeeping.

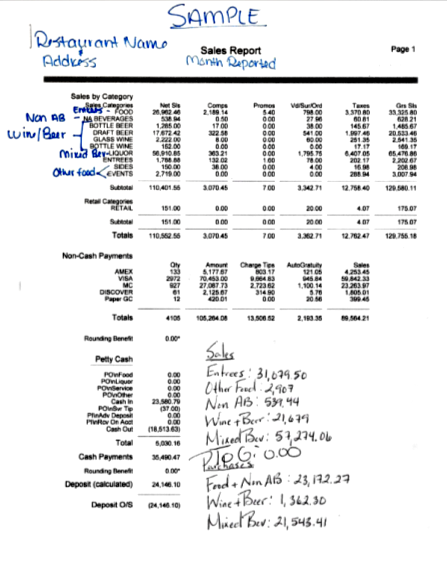

It is terribly important that your Point of Sale (POS) receipts, cash register receipts, sales ledger, etc. are reported per VA ABC Authority’s requirements. Your sales must be broken down into daily, weekly, AND monthly reports. In addition, every single sales ticket (to include cash sales and buffet tickets) must be kept, and attached, to your daily report. This report should indicate the following:

Sales

- Entrees (items with sides, buffet, or substantial meals such as spaghetti)

- Other Food (appetizers, side items, desserts)

- Non-Alcoholic Beverages (soda, tea, coffee etc.)

- Wine & Beer (this is the only category that can be combined)

- Mixed Beverages (this include liquor, shots, mixed drinks, and mixers)

- To Go (these items cannot count towards your minimum sale requirement or ratio.)

- Miscellaneous (hookah, tobacco, calendars, shirts, etc)

Purchases

- Food and Non-Alcoholic Beverages

- Wine & Beer

- Mixed Beverages

- Miscellaneous

Sales total must be less sales tax and not include Discounts/Comps. For example:

$10.00 Burger

+ $1.00 Sales Tax

= $11.00

– $5.00 Employee Discount

(Therefore, your Reported Sales Amount is $5.00)

Mixed Beverage Minimum Requirements:

- Entrees is $2,000

- Total Food is $4,000

Wine and Beer

- Entrees is $1,000

- Total Food is $2,000

(Please Note: Totals reported must match what is reported to the VA Dept. of Taxation).

Last thing we’ll say about this is that you should keep all sales records for 2 years. For 10 years, ABC Consulting has been offering a complete line of education and consulting services and we’d love to serve your business, too. What can we do for you? How can we help your business become more safe, solid and knowledgeable? 800.785.0161

*Disclaimer: The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. Information on this website may not constitute the most up-to-date legal or other information. This website contains links to other third-party websites. Such links are only for the convenience of the reader, user, or browser; ABC Consulting VA, LLC does not recommend or endorse the contents of the third-party sites. Readers of this website should contact their attorney to obtain advice with respect to any particular legal matter. No reader, user, or browser of this site should act or refrain from acting on the basis of information on this site without first seeking legal advice from counsel in the relevant jurisdiction. Only your individual attorney can provide assurances that the information contained herein – and your interpretation of it – is applicable or appropriate to your particular situation. The views expressed at, or through, this site are those of the individual authors’ writing in their individual capacities only. All liability with respect to actions taken or not taken, based on the contents of this site, are hereby expressly disclaimed. The content on this posting is provided “as is;” no representations are made that the content is error-free. In no capacity do we represent the Virginia Alcoholic Beverage Control Authority, IRS, SCC or any other government agency.